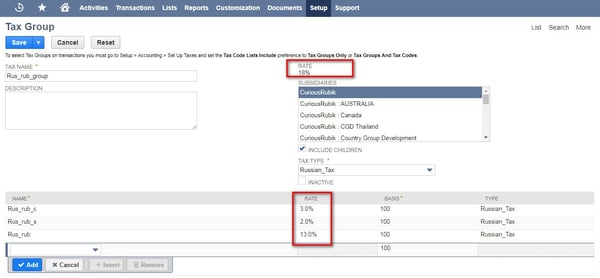

In some countries it’s required to club some tax codes under a common head and apply all of them together. In such cases, you will have to create Tax Group and define all the applicable tax codes which will fulfil this regulatory requirement.

Process :

- Before creating tax groups we need to create Tax codes that needs to be grouped and Tax Types. For creating new taxes check Setting up Nexus and Taxes in Netsuite.

- Now Go to set up > accounting > Tax groups.

- Choose the country for which you want to create tax group.

- Enter the name of the tax group and then choose subsidiaries for which it is applicable and applicable tax types.

- Now select the tax codes which you want to group under this tax group

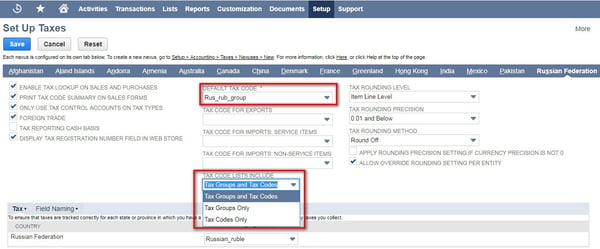

3. Setting up tax groups to be available in transactions you need to setup taxes.

Goto >> Setup >> Acounting >> Taxes >> Setup Taxes

- Here you need to setup preferences separately for each nexus.

- Select the nexus for which you want to setup preferences

- Then in TAX CODE LIST field choose one of the following as per requirement.

Tax codes only - Will display only tax codes in the transaction line level.

Tax Groups only- Will display only tax groups in the transaction line level.

Tax codes and tax groups - Will display both tax groups as well as tax codes.

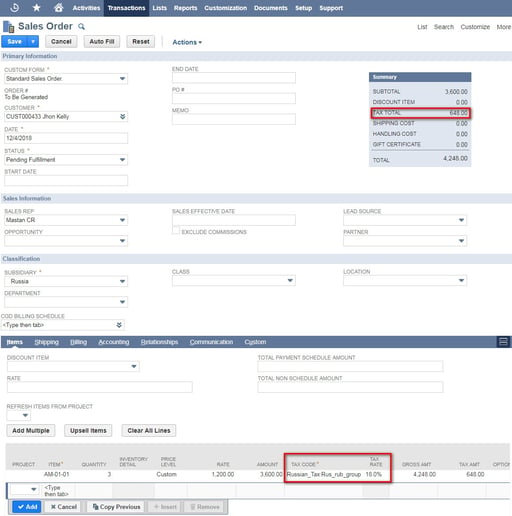

To use the tax groups in the transaction at the item level in the TAX CODE field choose the tax group that you want to apply (List will be displayed as per the options chosen in the TAX CODE LIST in Set up).

Go to Transactions > Sales > Enter sales orders.

Tax groups are useful for applying group of tax codes together to a transaction.

Twitter

Twitter Linkedin

Linkedin Youtube

Youtube Google +

Google + Face Book

Face Book