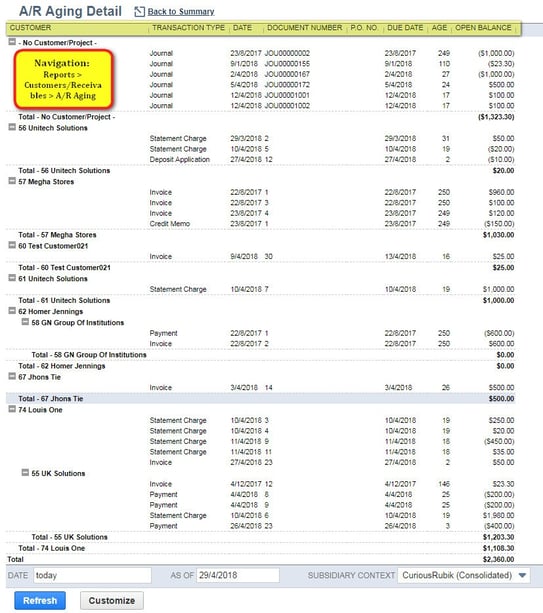

The Accounts Receivable (A/R) Aging Report shows you how much you’re owed (unpaid invoices, statement charges & Credit Memos) at any point in time by each of your customers. You can use the report to keep track of:

- How much your customers owe you.

- How long your customers have owed you money.

- Which of your customers owe you the most money.

- In the Detailed report, due dates for sales invoices.

A/R Report includes the following sections:

- Customer.

- Transaction Type: Below mentioned transactions are Involved in ‘A/R Aging’ report

- .Invoice

- Statement Charges.Invoice .

- Credit Memo.

- Payment.

- Deposit Application.

- Journal.

- Date: Transaction entered date in system.

- No (Document No).

- P.O. No.

- Due Date: The date on which the transaction amount was due.

- Age: The number of days past due.

- Amount Due:The amount due itemized by transaction and grouped by customer or project total.

Navigation: Reports > Customer/Receivable > A/R Aging.

When transactions are appear in ‘A/R Aging’ report?

- Invoice: Unpaid invoices.

- Statement Charges: Unpaid Statement Charges.

- Credit Memo: When credit memos are created then it will appear.

- Payment: Payment amount > Invoice amount scenario (Payment Record).

- Deposit Application: When void the ‘Customer Refund’ (Void scenario ‘Journal’ is opened automatically after save the journal the refund amount appear in credits).

- Journal: When created ‘Journal’ record.(When use ‘Account Receivable’ accounts in line level ‘journal’ record).

This report can help to ensure that your customers and clients are paying you. It at least tells you where they stand so you can take steps to collect if necessary.

Twitter

Twitter Linkedin

Linkedin Youtube

Youtube Google +

Google + Face Book

Face Book