Tax period defines a period of time where we can track taxes

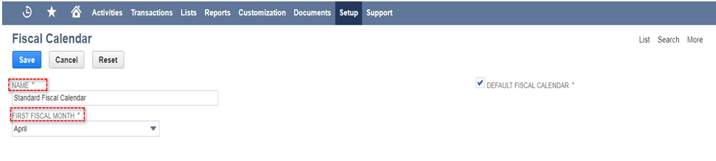

1 Fiscal calendar :Create Fiscal calendar (go to Set up > Accounting > Fiscal Calendars(G/L)

Go to (set up > accounting > manage tax periods)

Tax periods can be set up in 4 ways

- Set up full year

- New year only

- New quarter only

- Base period

SET UP FULL YEAR

- Choose the Fiscal Calendar on which this tax periods has to be created

- Choose the year end and periodic format(how many periods has to be set up in this year can be chosen -- Calendar months, 4 weeks and 4-4-5 weeks )

- In the fiscal calendar field choose the fiscal calendar that is required

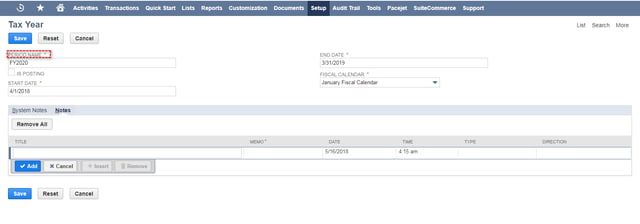

NEW YEAR ONLY

- Creating only the period

- Choose the start date and end date for this period

- Also choose the Fiscal Calendar on which this period has to be created

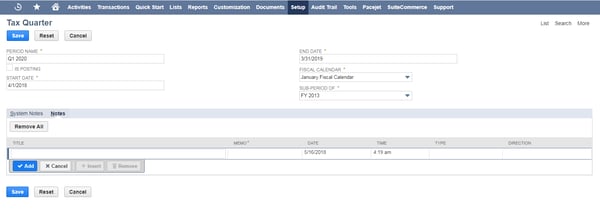

NEW QUARTER

- Choose the start date and end date and the Fiscal Calendar

- This Quarter period has to be added to a parent period so it is necessary to choose the parent period in SUB PERIOD OF field

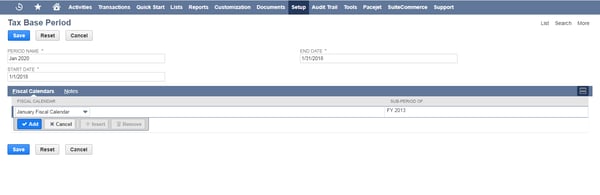

BASE PERIOD

- While creating base period we need to select parent tax period and define calendars to which these tax periods are applicable

Closing Tax Periods

- FOR NON - ONE WORLD To close tax periods go to (Set up > Accounting > Set up Tax (Taxes) and click on the status icon of the period that you want to close and click close tax.

- FOR ONE WORLD -- Click on the status icon of the period that you want to close

On the close tax page choose the subsidiary so that only for that particular Subsidiary the period will be closed

Twitter

Twitter Linkedin

Linkedin Youtube

Youtube Google +

Google + Face Book

Face Book