Nexus is a legal term that refers to the requirement for companies doing business in any country to collect and pay tax on sales in that country. Nexus is used to determine different sales and purchase taxes for a subsidiary. Each country has its own rules for determining nexus. Nexuses are part of the NetSuite Advanced Taxes feature, which is required for NetSuite OneWorld. Each subsidiary must be associated with at least one nexus.

Setup

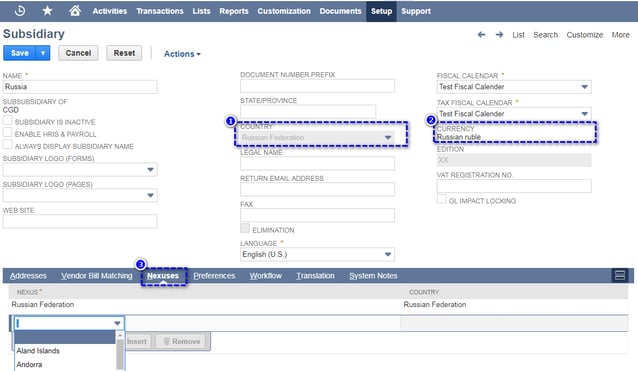

1. Subsidiary : In NetSuite each subsidiary record should be assigned with the nexuses in which it must pay taxes.

Go to Setup > company > Subsidiaries

- Select country for which that subsidiary belongs to.

- Select the currency of that country if already exists else create the currency.

- After saving a subsidiary record for the first time, system checks if the subsidiary country nexus is created or not and if the nexus exists then system will add the nexus to the subsidiary, else system auto creates the nexus and assign that to subsidiary. If a subsidiary does its business in multiple countries, then we must add each country’s nexus to the subsidiary record.

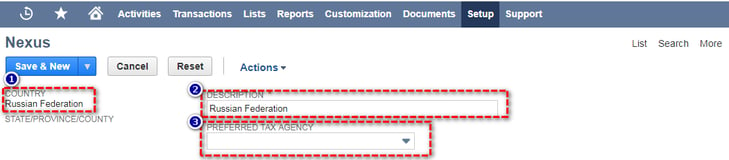

2. Nexus:

- You can set tax priorities for each Nexus to collect taxes and pay.

- Go to Setup > Accounting > Nexus

- Select country for which that nexus belongs.

- By default select country will be displayed , you can modify if required.

- Set the prefered tax agency in edit mode.

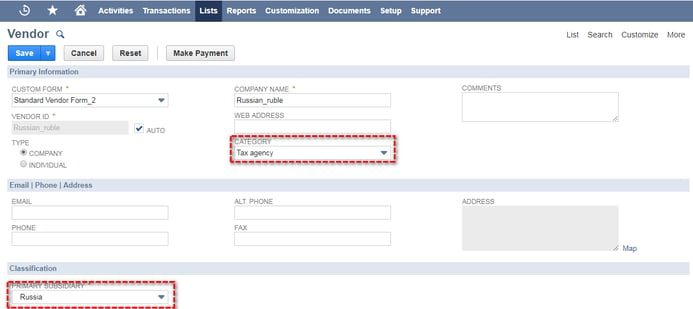

/setting-up-nexus-and-taxes-in-netsuiteEvery business collects taxes from both sales and purchases. Then the collected tax amount should be paid to the tax administration on behalf of the customers. When you create a nexus, default tax agencies are set up automatically by the system. You can use vendor as a tax agency

Go to List > Relationships > Vendors > New .

- For using vendor as tax agency select category as tax agency.

- Now you can select that vendor as tax agency in Nexus setup.

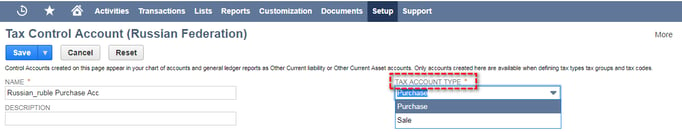

The balance sheet account to which NetSuite posts the collection or payment of tax is called the tax control account, Tax control accounts are accounts in your general ledger, Tax control accounts are used to define tax types, and tax types are used to define tax codes.

Go to Setup > Accounting > Tax Control Account > New.

- Enter name for that tax control account.

- Select the account type applicable for that tax control account.

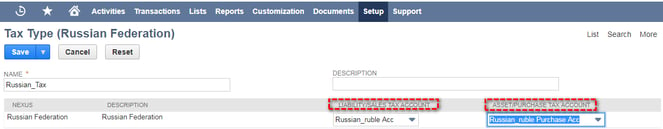

5. Tax Types

A tax type is used to identify which type of tax is being applied.

Go to Setup > Accounting > Tax types > New

- Select tax control accounts applicable for that tax type during sale and purchase transactions.

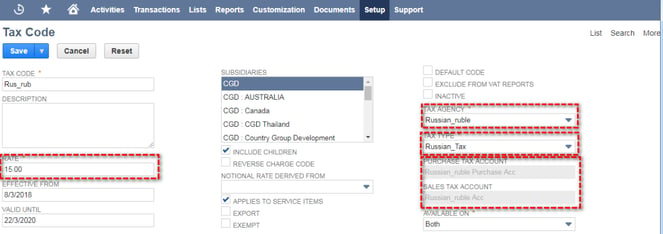

Tax Codes include information about tax rates and taxes that apply to transactions, Tax codes must be set up with Tax agency, Tax type, Tax control accounts.

Go to Setup > Accounting > Tax codes > New

- Enter name for that tax code.

- Give tax rate(percentage) in rate field.

- Select Tax agency, and applicable Tax type.

- Select applicable subsidiaries.

- You can define tax codes for a particular period based on effective dates.

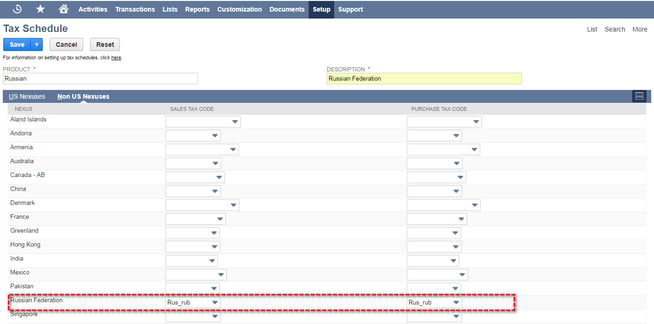

7. Tax schedule

Tax schedules define how NetSuite calculates taxes for items in each nexus. Tax schedules helps in calculating taxes based on items as some items don’t have taxes in some states.

Nexus is used in tax law to describe a situation in which a business has a "nexus" or tax presence in that state. If a taxpayer has nexus in a particular state, the taxpayer must pay and collect sales taxes in that state and pay income tax on income generated in that state.