Payment item is useful for tracking the down payments in ‘Sales Transactions’. We can easily to mention down payment by using payment item as per our business requirement.

For example customer purchased an ‘XYZ’ item with cost of $ 1000. But he want to pay ‘down payment’ $ 5,000 and remaining amount he will pay in installment process. So above $ 5,000 down payment tracking by ‘Payment’ item in ‘Sales Transactions’

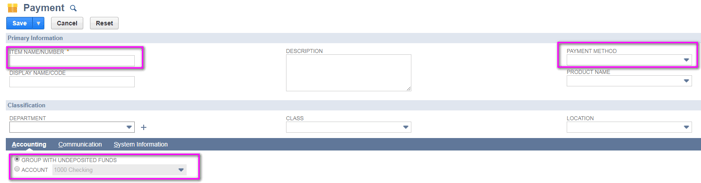

How to create ‘Payment Item’ record:

- Go to Lists > Accounting > Items > New.

- Click on ‘Payment Item’.

- Item Name/Number: Enter the payment. Ex: Cash Payment, Card Payment, Tokens Payment, Check etc,.

- Payment Method: Select the payment method for payment process happens through cash, card, check, Amex etc.

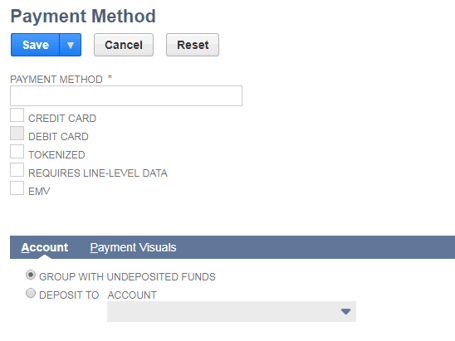

To create ‘Payment Method’,

Go to Setup > Accounting > Accounting Lists > New > Payment Method.

- Payment Method: Enter the name of the Payment Method.

- Checkboxes: Select checkbox payment happens through.

- Account Subtab:

Deposit to Account: If select this option payment immediately deposited to selected account. For example customer do the payment through credit card, debit card by using swiping machines amount directly deposited to account.

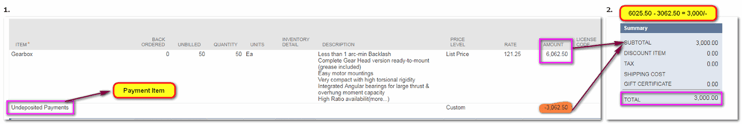

How the ‘Payment Item’ works in ‘Sales Transaction’:

Go to Transactions > Sales > Enter Sales Orders > New).

Enter the payment item in ‘Sales Transaction’ for how much amount customer need to pay down payment for purchased item. Enter the ‘Payment Item’ and mention the amount how much need to reduce from purchased item. In the summary shows the remaining amount (Customer Purchased item amount - Down payment amount = Remaining amount that shows in summary).

Twitter

Twitter Linkedin

Linkedin Youtube

Youtube Google +

Google + Face Book

Face Book